The legal industry is changing quickly as new technologies, especially AI, become part of everyday work. Law firms are expected to handle more matters, manage increasing documentation, and maintain accuracy under tight deadlines. This has made legal workflow automation an essential tool for reducing manual administrative work and bringing more structure to routine processes.

Instead of relying on AI as a replacement for legal expertise, many firms now use it to support automated workflows that handle repetitive steps in a predictable, consistent way. When tasks such as preparing service agreements, managing approvals, or processing invoices flow are standardised in an automated path, the workload becomes clearer, the risk of errors decreases. With workflow automation, teams can focus more on the legal work itself.

Why workflow automation matters in law firms

Lawyers are overloaded with repetitive administrative tasks – drafting documents, chasing approvals, and managing invoices. Legal workflow automation helps law firms eliminate this manual burden by standardizing and digitizing key processes.

But not every workflow is equal. Some tasks are occasional; others touch every client relationship. Three workflows stand out for their daily impact on client satisfaction and firm revenue: service agreements, billing and debt collection.

What is legal workflow automation?

Legal workflow automation refers to using software to streamline routine legal processes – from document drafting and case workflows to task tracking and reporting. It ensures consistency, reduces manual effort, and minimises errors.

Crespect focuses on automating the workflows that most directly influence a law firm’s success, revenue streams and often generates significant overhead costs if not properly streamlined.

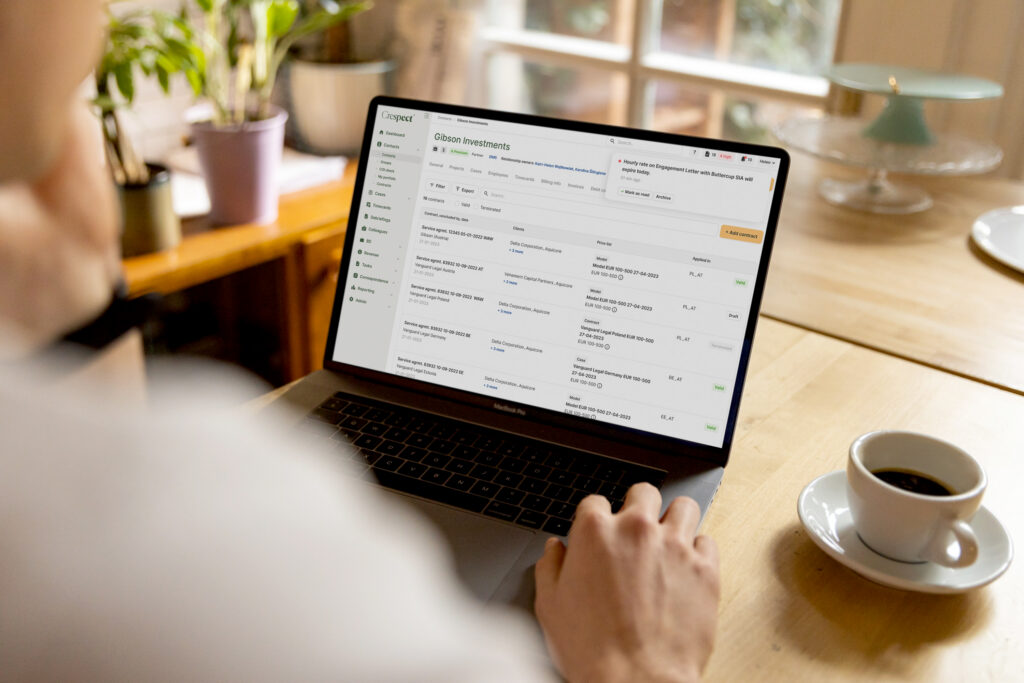

Service agreement workflow automation

Every client relationship begins with a contract, is it a service agreement, an engagement letter, representation agreement, or client engagement contract. Handling these manually is slow, error-prone, and risky – outdated rates, missing signatures, or expired contracts can all hurt client trust and compliance.

With Crespect’s service agreement workflow automation for law firms, you can:

- Use pre-approved templates for consistency and compliance.

- Track validity and renewal dates automatically.

- Get compliance flags if a contract is missing, unsigned, or expired.

Benefits: faster onboarding, fewer mistakes, consistent pricing and billing terms, and no more accidental use of outdated rates.

Billing workflow automation (from timecards to paid invoices)

Billing is one of the most tedious yet business-critical tasks in any law firm. Manual invoice creation delays cash flow and often leads to disputes.

With Crespect’s billing workflow automation, you can:

- Automatically manage invoices from logged timecards.

- Route them through clear approval workflows.

- Apply corrections or write-offs swiftly.

- Send invoices directly from the platform.

- Track payments and overdue accounts through accounting integrations.

Benefits: faster billing cycles, improved cash flow, and fewer client disputes.

Streamlined debt collection

If the challenges of legal work ended with issuing an invoice, the profession would be far less stressful. Unfortunately, chasing overdue payments is still part of reality, for both business services teams and fee earners, who often end up as the ultimate nudgers.

With Crespect’s automated debt collection, firms can turn this tedious process into a seamless workflow:

- Automated reminders and payment warnings sent on schedule;

- Recyclable templates of follow-up emails without manual effort;

- Smart receivability classification, helping identify and prioritise invoices at risk, so firms can act early and minimise write-offs.

Why focused workflow automation beats “One-size-fits-all”

Many generic workflow tools try to automate everything – and end up being overly complex. Crespect takes a different approach: it focuses on the main workflows every firm depends on daily.

This specialisation means faster adoption, smoother user experience, and quicker ROI.

Key benefits of legal workflow automation

Even small process improvements can create significant financial and operational impact. Automated workflows help law firms:

-

Reduce human error by using standardised templates and predefined workflows

-

Shorten turnaround times for agreements, invoices, and approvals

-

Improve profitability through faster billing and fewer write-offs

-

Increase lawyer productivity by removing low-value administrative tasks

-

Strengthen compliance with documented, auditable processes

-

Enhance client experience with consistent communication and faster responses

Legal Workflow Automation – FAQ

1. Does workflow automation replace lawyers?

No. It removes repetitive admin work so lawyers can focus on legal expertise and client communication.

2. Is automation secure and compliant for law firms?

Yes, modern solutions include access control, audit trails, encryption, and role-based approval workflows.

3. How long does it take to implement automation?

Most firms start seeing benefits in 30–60 days depending on the workflows automated.

4. What types of law firms benefit most?

Any commercial law firm, boutique firms, and any practice with recurring agreements or high billing volume.

5. Is our current practice management system enough?

Practice management tools schedule tasks; workflow automation executes tasks. They complement each other, not overlap.

See Crespect in Action

Want to see how billing and contract workflow automation works in practice?

Book a demo and discover how Crespect saves time, reduces risk, and gets invoices paid faster.